Have you ever asked yourself any of these questions on the left, suggested by Google? Likewise, if you like to gamble, it is important that you know how much you can and should spend gambling.

Recently we have seen politicians engage in talks with regulators, both struggling to come up with a threshold for how much users should be allowed to lose before the flags of problematic gambling would rise.

In my opinion, that threshold should be left to consumers, and governments and operators should focus more on educating and providing easier access to treatment.

Also, I prefer to talk about expenses rather than losses, and the reason is simple. Losing is opposed to winning, and gamblers are notorious for having a desirability bias. They will tend to overestimate the likelihood of winning, and for this reason it is important to use the word expenses, which implies receiving a good or service in return.

To enable a gambler to understand their limits, simply saying “Never bet more than you can afford to lose” just doesn’t work. Therefore, gambling should be first classified for what it is, a leisure activity.

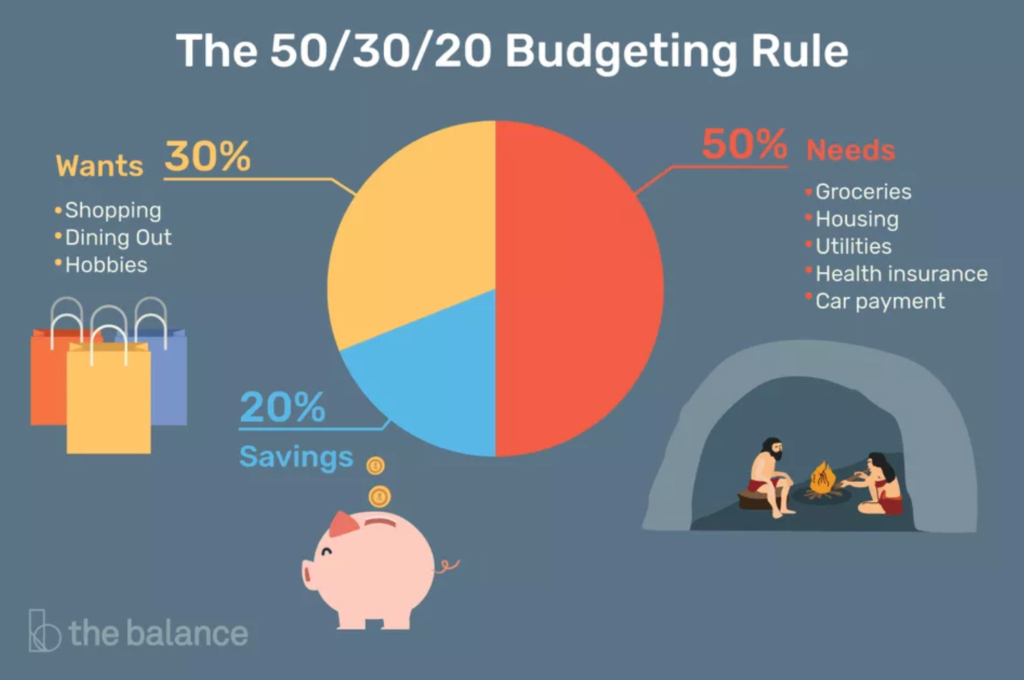

There is a simple budgeting rule which I like: the 50/30/20 rule.

This micro-management trick is helpful for people who have troubles being disciplined with their spendings.

It consists in dividing your income in three parts: 50% of it should go to NEEDS such as food, rent, bills, car payments and insurance. 30% of it should go to WANTS, activities such as shopping, eating out, hobbies, going to the movies or to the pub. And the remaining 20% of the income should go to SAVINGS.

For example, if your monthly Net Salary is $2,000, you should spend $1,000 in NEEDS, $600 in WANTS, and $400 should go to your savings account.

As discussed, Gambling is a form of entertainment, so it definitely falls under the WANTS. At this point, you should ask yourself how much you enjoy gambling. If you prefer gambling rather than buying a brand new pair of shoes or the latest iPhone, then you can spend on it a larger chunk of those $600 each month. But if you would rather go to restaurants or play golf instead, then you should spend less money gambling.

What is truly important, is to never gamble part of your NEEDS or SAVINGS budgets. That is when gamblers start having guilty feelings, begin chasing losses and enter into a dangerous vicious cycle.

If you found this article useful, read also our tips on time management.